March-quarter earnings are public, and key players have provided visibility into the embedded-market recovery, data-center dynamics, and PC-processor challenges. The big news is that although AMD and Intel are nurturing fast-growing AI accelerator businesses, revenues that once would’ve been considered a huge success are now underwhelming.

Data Center

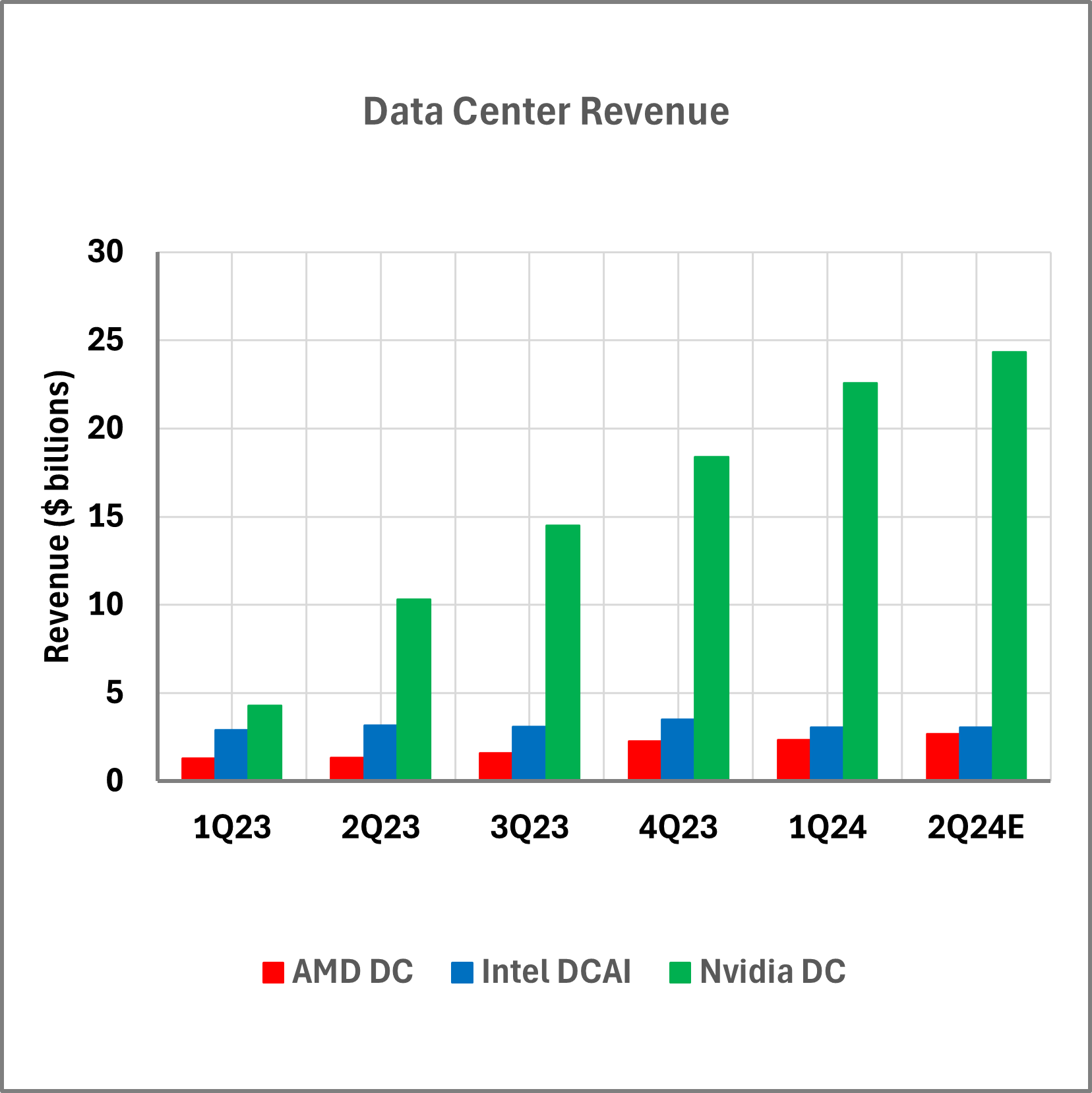

A sure sign we live in interesting times is that a semiconductor product generating $500 million in sales over six months is practically a failure. This is the sum that Intel expects its data-center accelerators (mostly Gaudi 2 until Intel Gaudi 3 begins contributing next year) to achieve in the second half of 2024. Crazier yet, AMD disappointed investors by raising its guidance for full-year accelerator sales (mostly AMD MI300) by the same amount, bringing the 2024 total to $4 billion. Such is the semiconductor industry’s nature, where share leadership fuels the investment that advances share leadership. Laggards either fall further behind or consume cash from other businesses to catch up. Significantly, AMD will not be supply constrained in the second half, giving the company room to beat its projection but also outlining the limited demand for its product.

Customer spending on AI accelerators (NPUs/GPUs) leaves fewer funds for general server processors, but sales are nonetheless increasing. Owing to higher Xeon prices (likely driven by the Sapphire Rapids refresh) and improved enterprise demand, Intel reported 5% year-over-year data-center growth in Q1, as Figure 1 shows. However, Epyc’s gains far outpaced Xeon’s. AMD characterized it as a vague “double digits.” It was probably closer to 30% than 10%. Worryingly for Intel, AMD also attributed 1Q24 success to the enterprise segment, an area where its rival has remained comparatively strong as Epyc gained at hyperscalers. AMD is bullish about the rest of 2024, especially with the next-generation Epyc (Turin) set to begin shipping. For its part, Intel expects to regain share starting at the end of the year as its next generation ramps. In other words, Intel is conceding near-term share losses.

Figure 1. AMD, Intel, and Nvidia data-center revenue. (Data source: companies, except for estimates.)

Update 1: AnandTech has published Mercury Research data showing AMD has a 23% unit share in server processors and a 33% revenue share, illuminating Epyc’s premium. On the positive side for Intel, its 80% unit share has been steady for three consecutive quarters.

Update 2: The following was added May 23, 2024, to accommodate Nvidia, which skews its fiscal year by a quarter.

Nvidia’s first quarter extended its meteoric data-center trajectory, growing its top line by 427% year over year. Within data center, computing quintupled and networking tripled. Regarding the latter, the company reported supply constraints. Although InfiniBand drives networking revenue, the company also offers Ethernet and reports that its new Spectrum-X gear will be a multibillion-dollar business within a year. One customer is standing up a 100,000-GPU cluster networked with Spectrum-X. Holding back growth this past quarter are export restrictions curtailing China sales.

Nvidia provided additional color on the data-center business, lending insight into large-scale AI generally:

- Large cloud companies account for more than 40% of revenue.

- Inference accounts for about 40% of revenue.

- Automotive (e.g., Tesla) is the biggest enterprise vertical.

Regarding its outlook, the company expects revenue, which data center now dominates, to climb from $26 billion to $28 billion this quarter. The new upgraded Hopper H200 will ship this quarter. Nvidia Blackwell is in production and should be available by the end of the year. Both the H200 and Blackwell are supply constrained. Nvidia also stated it is raising its new-product-introduction cadence to an annual rate, challenging competitors to catch up.

In an apparent effort to justify its high prices, Nvidia claimed that a cloud provider can generate $5 in GPU-instance-hosting revenue for every $1 spent. The same investment amount can generate $7 over four years if applied to hosting a large-language model like Llama 3. You gotta spend money to make money!

PC

A year ago, inventory buildup plagued both Intel and AMD, enabling the companies to post strong annual growth over 1Q23, as Figure 2 shows. The two-year comparison is more appropriate given the demand and inventory-consumption issues the companies faced at the start of 2023. Neither client business, however, has returned to 1Q22 levels, and AMD’s recovery is further behind percentagewise than the much larger Intel.

Figure 2. AMD, Intel, and Nvidia PC revenue. (Data source: companies, except for estimates)

However, in its first-quarter earnings call, AMD touted doubling Ryzen Mobile sales, indicating it is securing traction beyond PC enthusiasts, who disproportionately favor desktop machines. Ryzen’s surge comes as back-end (packaging) capacity is constraining Intel Meteor Lake. AMD guided to sequential growth and share gains, consistent with Intel projecting its client business to be flat. Despite Ryzen’s positive outlook, AMD’s PC-processor sales remain far smaller than Intel’s.

The following was added May 23, 2024.

Nvidia’s gaming revenue has roughly paralleled AMD’s client revenue for the past few quarters. Its newest GPUs have sold briskly despite their high price, propelling revenue.

Embedded

To track the diverse embedded market, we consider a limited sample comprising the big PC- and server-processor companies, which also address the market, along with Microchip. Although all three offer embedded products, the businesses captured here are distinct. AMD’s embedded revenue mainly comprises FPGAs, which Intel and Microchip also sell but account for elsewhere. (AMD’s FPGA-processor combinations, such as Zynq, are a big part of its portfolio.) Processors represent most of Intel’s “NEX” (embedded) revenue, but NEX also includes Ethernet controllers and other components. As for Microchip, we’re considering only its microcontroller (MCU) business. Collectively, these companies represent the state of the embedded market.

The market continues to be in a cyclical downturn, as Figure 3 shows, depressed in part by weak telecom-equipment sales owing to 5G being well past its initial ramp. Because it relies so much on distributors, Microchip is particularly susceptible to whipsawing revenue. The company finds consumption exceeds shipments—Microchip is selling less to distributors than distributors are selling to their customers. Once disty inventories normalize, Microchip should begin to grow. Moreover, the company reported rising bookings and declining cancellations and pushouts, further auguring for growth.

Figure 3. AMD, Intel, and Microchip embedded revenue. (Data source: companies, except for estimates)

Microchip guided to further decline but expects the June quarter to be the cyclical bottom. AMD’s guidance was similar, calling for next quarter to be the bottom. Intel, however, projected sequential growth for NEX.

Bottom Line

First-quarter earnings show the PC market to be in the middle of a cyclical recovery, and an embedded-market rebound should be underway in the third quarter. In the data center, server-processor sales are increasing while AI processors (NPUs/GPUs) boom. AMD leads Intel in catching the AI wave and trails far behind Nvidia, while hyperscalers’ in-house designs pose a formidable challenge.

AMD’s data-center business will be larger than Intel’s in a few quarters, a feat Nvidia already accomplished, creating a PR nightmare for the erstwhile leader. Intel’s client business will maintain its commanding lead, but AMD’s products have advantages. Owing to its share, Intel is also disproportionately threatened by Arm-based PCs employing Qualcomm Snapdragon X. Accounting for 80% of its operating profit, Intel’s PC-processor business fuels the company’s ambitions as Intel’s 5N4Y plan enters its final phase and the company’s data-center AI investment ramps up.

Leave a Reply